|

The operating profit margin is a vital financial metric comes under Profit & Loss statement, which shows how much of a company's profits come from its main business operations before the taxes and the interest are removed. It offers judgment into how effectively a business is handling its company operations while simultaneously earning money.

Suppose a Company ABC producing some finish product from raw material and sales the finish product in the market,

For current year total revenue generated from the sales of finish product are Rs. 10,00,000

Amount required for purchasing Raw material are Rs. 3,00,000

Amount required for operation to convert raw material to finish goods are Rs. 2,00,000

Amount required for Manpower and other fixed expenses are Rs. 2,50,000

These above amounts required for purchase of raw material and for conversion for raw material to finish product and man power and other fixed requirement are comes under expenses

So, the total expense for converting raw material to finish product is Rs. 7,50,000

And the Operating profit = Total Revenue - Total Expenses

= 10,00,000 - 7,50,000

= 2,50,000

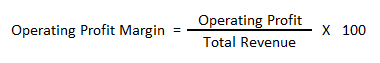

Formula for calculating Operating profit margin,

The Operating Profit Margin makes it more straightforward for us to figure out how a company controls and manages its costs. It makes it possible to pinpoint top performers by comparing companies within similar industry. A larger operating profit margin demonstrates an organization's capacity to convert sales into real profit.

Disclaimer: This post is not considered a recommendation to buy, sell, or invest in any company; it is just intended for educational purposes. Do your own research and due diligence before making any investment decision, and talk to your financial advisor.

0 Comments

Please do not enter any spam in the comment box.